The

rally of the market currently has some wondering if a correction is in our near

future and if it is, are investors ready? According to Alan Valdes they

are. Valdes, the director of floor operations at DME

Securities stated, "The Fed's pumping $85 billion a month into the market

so there's no way for it to go down, but everyone's got their finger on the

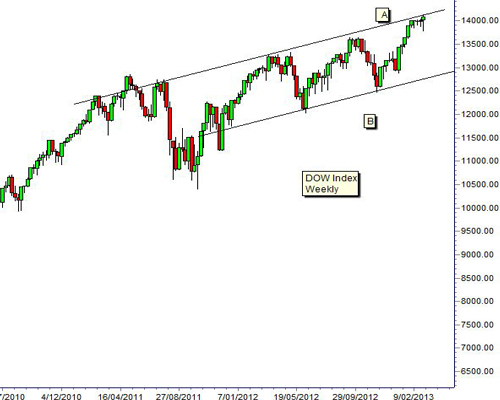

trigger because they don't know when this is going to turn." (CNBC) As you can see in the chart to the right, the DOW

has reached all time highs, breaking 2007 records. In the past, whenever all

three indexes have been on an upswing and excelled past their one-year peak line

there has been a slight correction. Investors

recognize this and understand the correlation between market highs and the

necessity of a pullback therefore leaving them waiting for the inevitable.

Nouriel Roubini, the economist who called the crisis in 2006, expects

the market to slow down in the second half of 2013. “I think that the market is

going to be surprised by how much the U.S. is going to slow down, even compared

to last year,” Roubini said, indicating the market could correct “somehow” and

lead investors to be disappointed. (Market

Watch Blog) Contrary to Roubini, Kenny Polcari, floor director of XYZ, believes

there will be a 5 or 6 percent pullback. However, the pullback will be met with

real demands, suggesting 2013 will still end high.

It is difficult to project what the market will do in the future and is

best left to the professionals, however, here is my prediction: there will be a

correction within the next three months around 4 to 6 percent and it will be

the most rapid correction in history. The previous

shortest correction lasted only 15 trading days in July of 1950.

If you are an investor, my advice is to listen to a reputable

investor’s wise words. Warren Buffet stated "Be fearful when others are

greedy and greedy when others are fearful."

No comments:

Post a Comment